Closing your eyes to your financial issues has never solved your problems in the past. It's time to budget your money with ease. All you need is an automated system and a few changes to your awareness. Check out our guide to saving a lot of money fast. Use your new-found knowledge and cash to establish a budget so you can spend money on the things you love guilt-free!

7 Steps to creating a budget that will guarantee freedom

Before worrying about your spending, let's focus on how you make money. List income sources with tax included. In other words, list your after-tax income. This is quite easy if you have a regular paycheque.

Remember to deduct taxes and business expenses! We want the amount of pie remaining after Aunty Maple and Uncle Sam have taken a piece out of it.

How to build your budget.

It took me a very long time to understand and utilize a budget myself. It required a lot of work and commitments to the changes I was prescribing myself. Discipline is key, find and develop your own system, and learn to follow it. It's unlikely that you will wake up one day and suddenly become a budgeting guru.

I realized for myself I needed it to be automated. I absolutely hate to have to track more things than necessary. So track something while I have the opportunity, once the situation is understood, I do everything necessary to automate the process.

Understand your situation

We all have different needs. It is important to make sure you know what you want out of a budget. Do you want more guilty free spending money? Maybe you are preparing for a wedding? Every situation will require you to have a different level of detail in your budget. Ultimately, each budget is very personal. What we are providing is the guideline feel free to tweak that to your desired settings.

Track your spendings.

There are some amazing free options to see where your money flows. A lot of times, people don't know where their biggest expenses lie. Utilize services like Mint to track your most recent expenses and where you spend the most amount of your income. Tracking your money and being aware of your spending will help you establish an amazing system to budget your money.

Find every single financial statement that you can get your hands on and pile it on to your table. Bank statements, investment statements, utility statements, credit card statements, you get the point. First, deal with all of your physical statements, and then download any electronic statements you may have. You should find anything that may have a source of income or expense.

When I made my first budget, I looked at all of my statements for the past 6 months. I suggest you start by looking over the last three months. This needs to be a detailed scan of each and every payment that is leaving or being added onto your account over that time frame. This is as hard as it gets, looking over all of your statements can be one of the most painful yet eye-opening things you can do. This activity forces you to realize where your money is going.

Break your budget down into three categories.

Income; use this category to list all the avenues of payments you may have.

Monthly Responsibility; this category should include your rent, health insurance, car payments, student loans, car insurance, credit card payments, utilities, etc. These are payments that get processed out of your accounts automatically. These expenses are also consistent, as in they should be generally the same month to month.

Other Payments; this category should include things you spend money regularly but the amounts are not consistent. Groceries, personal items, household products, transportation, entertainment, dining out, etc.

Establish your income.

Figure out your monthly income. If you get paid the exact same amount every month then your life is a lot easier than many. For those of you who work freelance, this can be a bit more tricky. The way I did this was, I looked at my average monthly income over the last 12 months. If you want to be safe use the month with the lowest earned income. This way your budget would be based around the safest amount and you would be able to pay your bills.

How much money do you have?

If you have a long term savings account, retirement account, and other mediums of quick access cash which come with penalties, make a note of all of that. This section includes funds that you have direct access to and the penalties associated with it. For instance, if you have a tax free savings account, with funds tied to index funds or stocks on a brokerage account, you can write down the amount and the costs associated with withdrawing the funds. This section should also include your checking accounts and other investment accounts.

The primary reason to do this activity is to visualize the impact your longer-term savings funds can have on your budget. In case you ever need to dip into it. It's not a matter of never using the money you save, it's about understanding when and where to use it.

Create a personal net worth chart. Not just for your current situation, but also make notes on where you want to be. Visualizing where you are in terms of money and assets and checking where the money can be distributed to bring you closer to your financial goals is an important metric to follow. It helps to print out these charts and keep them handy just to assess changes over time. Similar to going to the gym, it is a good idea to monitor and track the changes to your financial health. Because it will help keep you motivated and not stray from your goals.

What do you owe?

While there is a lot of reasons to budget your money. It is especially important if you are currently stuck in high-interest consumer debt. Find out exactly how much recurring debt payments you are required to make every month. This is fairly simple especially if you have stopped incurring additional debt in the short term.

Overall, debt can be utilized as a positive entity, only if you know-how. However, that does not include high-interest debt. It's too easy to over-leverage yourself and get stuck in a rut of interest for the rest of your life. Understanding what you owe and where your payments need to be diverted is a crucial aspect when you need to budget your money.

Three values are needed in this section; Total amount owed, Interest percentage and minimum monthly payments.

What is your average monthly expense?

Many people suggest it is important to track every single penny that you spend. Unfortunately, that is not possible for the majority of people. Here is a simpler way to track the metric. Print out your statements for the last 6 months and look for reoccurring monthly payments, this includes hydro, water and utilities, phone bill, etc. Things that come in monthly and has been certain over the last 6 months. Once you have that, feel free to use an app such as Mint to generate a report of an average of miscellaneous expenses over the last 6 months assume everything else can be lumped into that amount.

The reason why this helps is it gives you a general guideline to how much you are spending on average. With that, you can set up something engineers call a factor of safety (FOS). Which is just a multiplier of the amount you are spending a month with a small cushion. For instance, when designing loads, we will find the minimum capacity of the beam and multiply it by 1.5 to make sure there is space for mistakes.

Similarly, you should find an amount that works for you and the aggressiveness of your spending. If you are impulsive or feel as if you are prone to more emergencies (Not maintaining your car, not having health insurance, etc.) Then perhaps set a higher factor of safety in your budget for the funds that go into your checking account which should be automatically diverted after you get paid.

Create and adjust your budget according to reality.

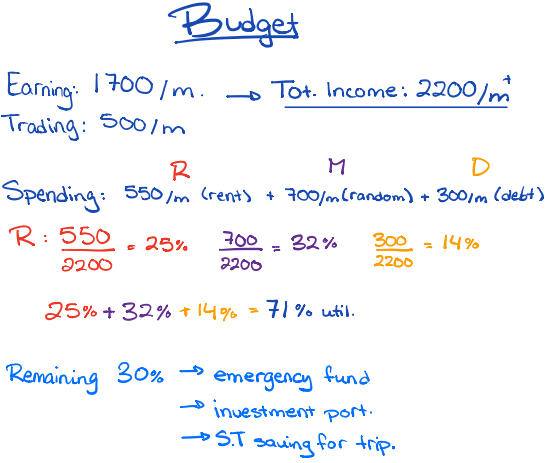

Create a section for all your expenses, and divide them by your total income to check how much each aspect of your expenses is eating into your earnings. We love using percentages, they are easy to monitor and also adjust. This way you can allocate higher percentages to paying off your debts forcing yourself to be more frugal earlier and then let off the gas as you reclaim more percentages from the debt payments and utilize them in other aspects of your life. This is the magic of budgeting your money.

In a later post, we want to show you exactly how to automate your budget allocations so there are fewer human interactions. You want to find the golden ratio when it comes to the percentages in your budget allocation and just let the computer do the rest. You should only have to check in every few months to monitor and establish changes.

If you live in a community where the price for oil and food is rising, I would not suggest you budget your money once and stick to it for the rest of your life. Depending on how difficult it is to stick to your budget, you should be continuously changing your allocations over time.

Therefore should you budget your money?

It's not difficult to budget your money. The difficult part is the discipline required to actually use it. It's difficult looking at a bunch of numbers on a page and willing to believe in it 100%. By following the few steps noted above you will be on a path to efficiently budget your money and achieve financial freedom.

That's why we are working on a simple budget builder and we hope to share it with the community for free. So if you are interested please register your email and keep an eye out!

We hope this helps you figure out another approach to your personal budget by taking out the stress. Do you have a budget? What do you use and what has not worked for you in the past? Please share how you budget your money in the comments below.